CLARITY IN NON RESIDENT TAXATION BROUGHT BY FINANCE ACT, 2020 viz a viz FINANCE BILL 2020

On 1st February 2020, when Finance Bill was presented by Finance Minister Nirmala Seetharaman the major panic created was amongst the NRI’s having citizenship in India and residing/working especially in tax free countries. This finance bill was drafted & presented in such a manner that ‘if a citizen of India is not a tax resident/payer in any country’ then he will become “Resident” in India, consequence thereby he should pay tax on the entire global income in India.

It is very pertinent to note that Finance Bill is only a proposal before the parliament &to get a legal status the same shall be presented in both the houses of parliament and then it should get Assent from President of India then only it will become an Act. After this finance bill presented by FM, it led to a major criticism across the globe and when the Finance act was implemented it was much harmonious and fear amongst the bonafide NRI has settled quietly.

Residential status of a person under Income Tax Act plays a vital role to determine whether a person comes under the tax net or not.

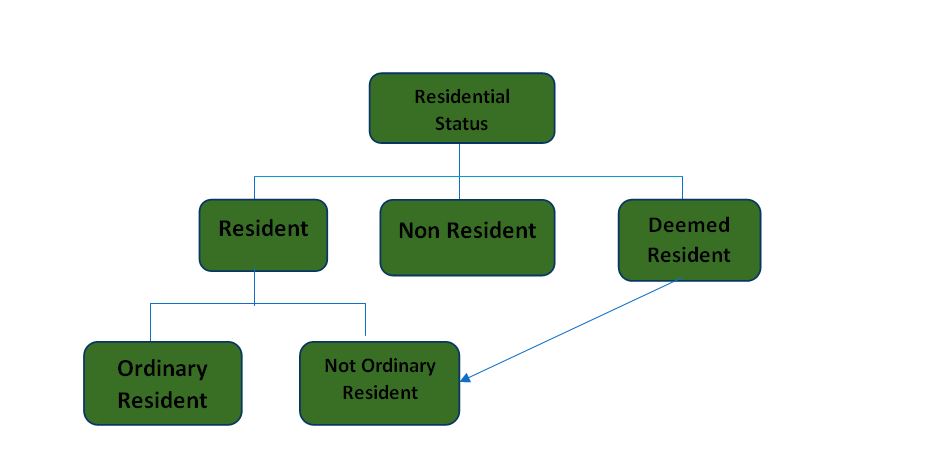

Earlier based on the number of days stay there were three categories under residential status, namely-

- Resident and Ordinarily Resident

- Resident but Not Ordinarily Resident (RNOR)

- Non – Resident

| Types of Income | Resident and ordinarily resident | RNOR | Non-Resident |

| 1. Income received/Accrued/Arise in India | Taxable | Taxable | Taxable |

| Income accrue or arise outside India and received outside India | |||

| a. Foreign Business income where business is controlled from India | Taxable | Taxable | Not taxable |

| b. Foreign Professional Income where Profession is set up in India | Taxable | Taxable | Not taxable |

| c. Any Other Foreign income | Taxable | Not taxable | Not taxable |

In Short a permanent resident in India will be taxable for Global Income and for a non- resident he is liable to pay tax only for the Income earned, accrued and received in India. Those who fall under Resident not ordinarily resident will be taxable only for these two categories of Income namely,

- Foreign Business income where business is controlled from India

- Foreign Professional Income where Profession is set up in India

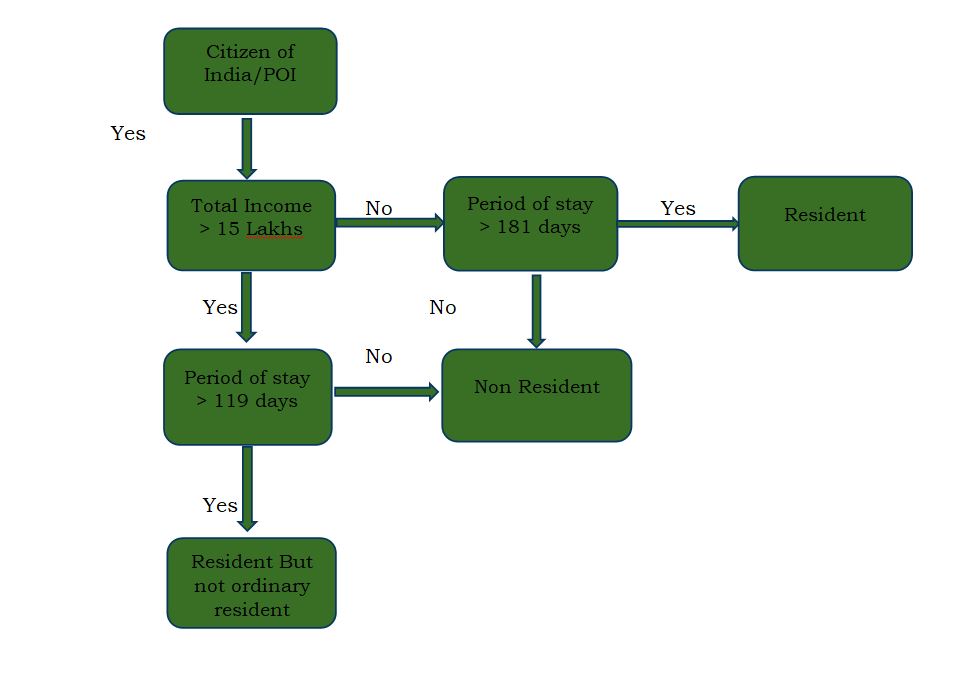

Now by way of creating deeming fiction under Income tax act they brought an amendment where in an individual who is an Indian citizen or a person of Indian origin having total income, other than the income from foreign sources, exceeding ₹ 15 lakh during previous year and his stay in India exceeding 120 days in the previous year will become a deemed resident. Deemed resident will always be treated as Resident but not ordinarily resident.

The same has been explained in the below diagram as well.

*The concept of deemed resident is introduced vide the Finance Act, 2020.

| Indian Income | No of days stayed in India | Residential Status | Impact of taxation in India |

| 16 Lakhs | 125 days | Not Ordinarily Resident | Taxable for Indian Income & two types of Income mentioned above |

| 14 Lakhs | 125 Days | Non Resident | Taxable only for Indian Income |

| 16 Lakhs | 119 Days | Non Resident | Taxable only for Indian Income |

| 12 Lakhs | 184 Days | Resident | Taxable for Global Income |

—————————————————————————————————————

The legal interpretation of amendment’s in the law has been illustrated in the below paragraphs,

Section 6 (Resident in India):

(1) The individual is said to be resident if he fulfil any of condition as mentioned in section 6. The said provision is read as under:-

- An individual is said to be resident in India in any previous year, if he-

- is in India for 182 days or moreduring that year; or

- is in India for period of 365 days or more during the 4 immediately preceding thatyears and for 60 days or more during that year.

Explanation. 1-In the case of an individual,-

In the following two cases the period of 60 days shall be substituted by 182 days.

(a) being a citizen of India, who leaves India in any previous year as a member of the crew of an Indian ship or for the purposes of employment outside India.

(b) being a citizen of India, or a person of Indian origin, who, being outside India, comes on a visit to India in any previous year.

- There is no change in explanation 1 to clause (a) by Finance Act, 2020.

- The amendment to explanation 1 to clause (b)made by Finance Act, 2020 is as under:-

An individual who is an Indian citizen or a person of Indian origin having total income, other than the income from foreign sources, exceeding ₹ 15 lakh during previous year, the word 60 days is substituted with 120 days.

Introduction Of Section 6(1A) Deemed Resident {Section 6(1A)}

“Notwithstanding anything contained in clause (1), an individual, being a citizen of India, having total income, other than the income from foreign sources, exceeding ₹ 15 Lakhs during the previous year shall be deemed to be resident in India in that previous year, if he is not liable to tax in any other country or territory by reason of his domicile or residence or any other criteria of similar nature.”

The intent of law is to tax such persons who were stateless. The categories of such persons are mainly film stars or sportsman or other persons. Such deemed residents will be considered to be ‘Resident but not Ordinarily Resident’ under the Act.

Section 6(6)– Not Ordinary Resident prior to Finance Act, 2020

An individual/HUF is said to be a not ordinary resident in India in previous year if he is covered by any of the following condition as laid down in Section 6(6).

- Such individual or Manager of such HUF has been a non-resident in 9 out of 10 preceding years. Or

- Such Individual or Manager of such HUF has been in India for a period of less than 730 days during preceding 7 years.

Amendment made in Section 6(6) (NOT ORDINARILY RESIDENT) by inserting additional provisions as below-

- a citizen of India, or a person of Indian origin, came on visit to India, such individual having total income (other than the income from foreign sources) exceeding ₹ 15 lakhs during the previous year and who has been in India for a period exceeding 120 days but less than 182 days. Or

- a citizen of India who is deemed to be a resident as per section 6(1A).

Explanation : For the purposes of this section, the expression “income from foreign sources” means income which accrues or arises outside India (except income derived from a business controlled in or a profession set up in India).

IMPACT OF AMENDMENTS:

Once an individual qualifies as Not-Ordinarily Resident pursuant to the amendment, the following consequences will follow:

Increase in scope of total income: Income that accrues or arises outside India but is derived from business controlled in or profession set up in India will now become taxable in India in the hands of such individual.

Loss of exemptions: Various exemptions that are available in the hands of non-residents will be lost once the status changes to RNOR. However, exemptions in respect of interest on NRE account balance and FCNR deposits will not be impacted by the amendment.

Loss of concessional rate of tax/ presumptive scheme benefits: Various nature of income that are taxable at concessional rates in the hands of non-residents (5% to 20%) will become taxable at normal slab rate applicable in the hands of such individuals.

Foreign assets reporting: Once an individual qualifies as a resident (including RNOR), he will be required to furnish a schedule called Foreign Asset in the return of income disclosing details of all assets held outside India.

Increased onus to substantiate non-taxability of income: Indian Income Tax Officer will have greater jurisdiction on such individuals and such individuals will be required to justify as to why income from a particular source is not taxable in India by establishing that such income accrues or arises outside India.

Conclusion:

The change in definition of the resident is brought to widen the tax base. The confusion which prevailed earlier when budget was announced is clarified after passing of Finance Act 2020.Now it has attained clarity. Indian Citizen/ Indian origin have to plan their travel stay in India limited to 120 days to not to come under the tax net provided he is having more than 15 Lakhs Income in India. The explanation clause “income from foreign source” has clarified income earned or accrued outside India is not taxable but the income from any business controlled or profession set up in India alone is taxable. The taxability of amount exceeding 15 lakhs other than the income from foreign source is a respite to the Indian citizen/ Indian Origin visiting India as it is clarified that all their global income is not taxable in India. The amendment to Section 6 vide Finance Act 2020, has a balanced approach by giving respite to genuine Indian Citizen/Indian Origin visiting India in one hand and at the same time to bring the Persons under the tax net under the concept of deemed resident who is purposely not paying tax in any country by reason of resident domicile etc. The impact that will cause due to the changes in Section 6 can be assessed only after the implementation of amended Section 6.