Is it Mandatory to File NIL Returns for the Person having TAN Number?

The last date for filing the TDS Statements for the Fourth Quarter of FY 2019-20 is coming closer. There will be many deductor’s who did not deduct any tax during the relevant quarter and therefore they will not file any statement for deduction of tax at source u/s 200(3) of the Income Tax Act’1961.

But do you know that for such deductor’s who have a TAN Number but have not filed the TDS statement as they did not deduct any tax during the relevant tax period, CPC (TDS) has started a functionality where the deductors can file a NIL Declaration i.e a declaration that the deductor did not deduct any tax during the relevant tax period and was subsequently not liable to file a tds statement.

Ques: What is a NIL Declaration of TDS Statement?

Ans: A NIL Declaration is basically a declaration for non-filing of TDS Statements for those deductors who were not liable to deduct any tax during the relevant quarter or have not deducted tax during any quarter and subsequently did not file a TDS Statement U/s 200(3) of the Income Tax Act’1961 for any quarter.

Ques: Is it mandatory to file a NIL Declaration?

Ans: As per Income Tax Act’1961 and the Income Tax Rules it is not mandatory file a NIL TDS Return.

Since filing NIL TDS Return was neither mandatory nor possible. The CPC (TDS) was having a problem distinguishing between:

1. Deductors required to file return but not filed the TDS Return.

2. Deductors not required to file return.

Therefore, In order to prove that the deductor was not required to file a TDS Return, it is advisable that the deductors should file A NIL Declaration of TDS Statement.

Ques: Where can I file a declaration for not filing a TDS Statement?

Ans: A Declaration for not filing the TDS Statement can filed by logging into the CPC (TDS) Website: www.tdscpc.gov.in

Ques: What is the procedure for a filing a Declaration for not filing TDS Statement/NIL Declaration?

Ans: Procedure for filing of declaration for non-filing of TDS statement is given below:

1. Login through your registered id at www.tdscpc.gov.in

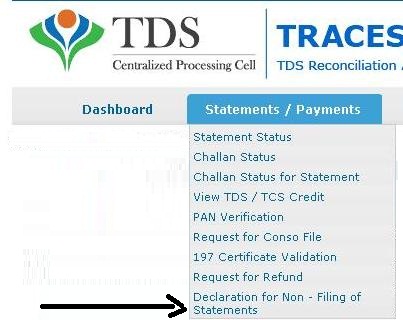

2. Go to “Statement/Payments TAB after login >then declaration for Non filing of TDS statement (as shown in the picture below).

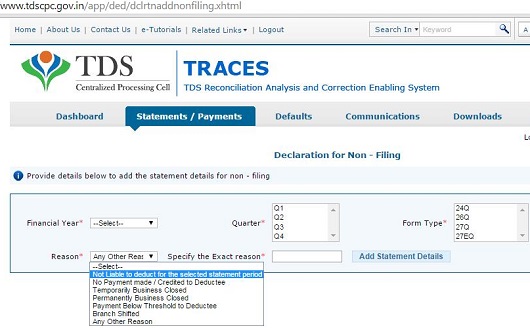

3. On clicking declaration for Non filing of TDS statement link you will get screen with options as shown below:

- Select financial year.

- Select Quarter.

- Select Fom type- 24Q, 26Q, 27Q or 27EQ.

- Select reason for non-filing of statement from drop down menu.

- In the Reasons column, the deductor can choose from the following options as shown below:

- Not liable to deduct for the selected statement period.

- No Payment made/ Credit to Deductee.

- Temporarily Business Closed

- Permanently business closed

- Payment below threshold to deductee

- Branch Shifted

- Any other reason

Also note following points:

- Fields marked by asterisk (*) are mandatory.

- ‘Specify the exact reason’ field will be mandatory if user selects ‘Any Other Reason’ in ‘Reason’ drop down.

- If deductor has permanently closed his business, the deductor should surrender his TAN to the jurisdictional A.O.

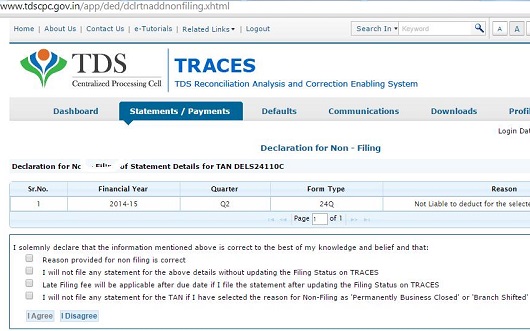

- After giving the reason for non-filing, Click proceed button after selecting required data. In next screen, you have to give a declaration/certificate as shown in the picture given below.

5. After certificate, following message will be shown.

“Filing Status for the statements selected by you has successfully changed. You will receive the details of the statements for which filing status has changed on your email.”. After this the your statement status will change to NON-FILING.

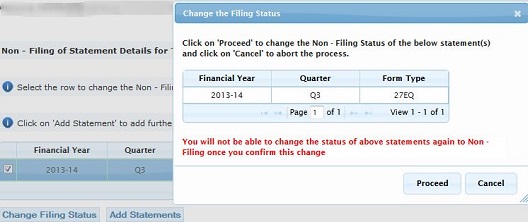

- The deductor can change back this status from non-filing and can file return, if required at later stage or you have wrongly updated status for incorrect period. But change facility is available for only one time for a selected period. To change the status you have to go again through “Statement/Payments TAB after login > then declaration for non-filng of TDS statement.

- Statement selected earlier as “non-filing can be updated by selecting the statement for a given period and click change filing status, and in next screen, you have to reconfirm your request by clicking the proceed button.

- After adding first statement to non-filing status, next time you will get screen as shown above and you can add other statement to non-filing status through add statement link.

Other Important points

User will not be able to declare a statement for a Financial Year, Quarter and Form Type for Non-Filing for the following cases:

- If user has already declared that statement for Non-Filing.

- If user has changed the filing status of that statement from Non-Filing to Filing.

- Traces website has provided the pictorial E-tutorial for the same on their site for user’s better understanding. The link for the same is as under: https://contents.tdscpc.gov.in/en/declaration-of-non-filing.html